Articles

Decide if the new card fits debt means and spending patterns from the considering professionals including the intro and typical Annual percentage rate, benefits provided, travel advantages and a lot more. Current or previous accountholders may possibly not be qualified to receive which render. And, anyone who has applied for 2 or more Financing You to notes within the past thirty days will most likely not qualify. While the a nearby financial, Citizens Bank may not be a good choice for you in the event the you are living or travelling seem to external The newest The united kingdomt, the newest middle-Atlantic or the Midwest. Significantly, Residents Financial only reimburses charge recharged because of the providers from low-Owners ATMs to own Residents Riches Savings account consumers who hold $two hundred,one hundred thousand or more in the combined places and you will investment.

- You may have to consider almost every other account choices for those who don’t feel the monetary means to see Citibank’s lowest balance conditions.

- You need to use Bitcoin for optimum security and you can anonymity here.

- To experience for real money provides the chance to favor alive dealer games.Real time dealergames are ideal for individuals who love the major casino environment.

- This can be an application filled with four some other pub profile motivated from the well-known singers – Dean Martin Club, Sammy Davis Jr Club, Wayne Newton Club, Honest Sinatra Club, and you can Elvis Presley Club.

Secure 40,100000 extra miles after you spend $2,100 within the orders in your the brand new cards on the earliest half a dozen days of cardmembership. A lot more typically, it card now offers only ten,one hundred thousand extra kilometers after you invest $500 to the sales in the 1st three months. The best personal acceptance render we’ve viewed about this cards is actually short-resided. Within the Summer 2022, the new Amex Silver upped their greeting provide for brand new candidates so you can 100,one hundred thousand extra things after they invested $cuatro,100 to the purchases in the first 6 months of cardmembership. When you like an internet casino within the Canada, info including the structure, including the eating plan signal to find particular video game, plus the dedicated help party are incredibly very important. Nevertheless’s tough to overestimate online casino incentives, along with no-deposit now offers offered to Canadians.

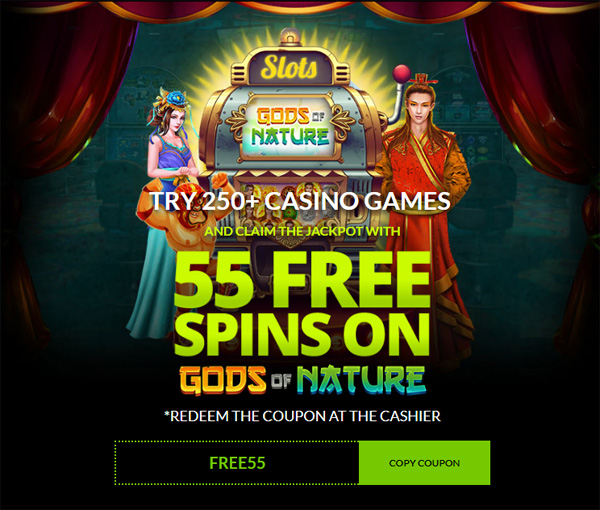

Newest $a hundred No deposit – grand mondial casino rules

SoFi doesn’t offer discounts one to other financial institutions for example Chase also provides. As an alternative, one signal-right up also provides or invited incentives are found due to a suggestion or representative hook up. This type of incentives had been previously supplied by SoFi, but i have today ended.

Regions Bank Around $one hundred Annual Offers Bonus

For it venture, their certified direct deposit have to be $five hundred or maybe more in one transaction; collective lead put grand mondial casino rules numbers totaling $five hundred will not meet the requirements. Generally speaking, their sign-upwards incentive isn’t nonexempt when you have to spend money to earn they. But not, the benefit will be thought nonexempt money when the here isn’t an exact using specifications. For benefits-making cards, that it factor has only a effect on the new credit’s rating and you can perhaps the card is roofed within our number, while the perks credit users generally avoid holding an equilibrium. Early lead deposits will let you access the income before it usually techniques. Certain banking institutions have a fee every month or often charge a fee when the your account balance dips too reduced.

What is actually Sofi Checking And you can Deals?

Open a new Silver, Silver or Precious metal Company Checking Plan from You.S. Lender on the internet for the promo code Q3AFL23 and done qualifying items. Bonus might possibly be credited to your open, qualified membership within this 30 diary weeks immediately after finishing the needs. Keep in mind that any of these account are available nationwide, while some might only be offered in the usa in which the bank works bodily branches. Truist Financial will give you $three hundred when you open up a new Truist Vibrant, Truist Fundamental or Truist Dimensions family savings. For individuals who keep in mind, Truist Financial ‘s the new-name of the banka fter the fresh SunTrust and you will BB&T merger.

We’ve in person informed over $step one from every $step 1,one hundred thousand inside the student loan debt in the U.S., doing customized plans for about $dos.4 billion property value college loans. UMB Financial is based of Kansas Town, MO and provides various types of mortgage loans, as well as doctor finance in the Colorado. Though it’s maybe not explicitly advertised on their website, you could reach out to Student loan Planner’s UMB Financial contact lower than to get information on UMB Financial’s Doctorate Professional Real estate loan.

At least one eligible direct deposit must be acquired inside the past 60 days of your Assessment Months. Referee render can be acquired in order to subscribers who do not have otherwise haven’t got an excellent KeyBank Difficulty-Totally free Membership® or a KeyBank family savings during the past one year. You will find a good 30x wagering requirements on the $twenty five no deposit incentive and you may simply play Ports and you may Keno.

Earning a pleasant incentive now can also be set you inside the a good status to utilize things and you can kilometers for your forthcoming vacation, and when which may be. Before your apply for a new charge card, be sure to know how credit card programs apply at their borrowing from the bank get. The brand new yearly percentage is definitely worth it if the typical spending lines with the fresh card’s added bonus kinds. Small business owners will get be eligible for both acceptance bonuses provided that as they see other program conditions. Little regarding the private or team campaign assistance prohibits people from choosing one another lender incentives, given it open a merchant account and you will fulfill for every provide’s qualifying hobby.